HOME LOAN

To make your home loan journey a smooth sail, in this article we will help you to know eligibility criteria, rates of interest, process, necessary documents, EMI comparison and transfer for lowest rates. Home loan is really critical and important financial decision in our lives. Before you finalise your bank to secure home loan, try to get more information on current interest rates from different banks. First, gather some more information about how much each bank can give you. Find out eligibility for government and private banks. Which interest rate is more flexible and affordable such as fixed rates or floating rates? What is more easy a prepay option or balance transfer? We try to give answers to all such questions, and make this home loan process simple for you.

To find the lender for 20 years term go through the fine print and save for years to come. A perfect Home loan is loan which gives you lowest rates throughout the tenure, has part payment options and allows you to balance transfer if you wish to.

HOME LOAN BALANCE TRANSFER

Home Loan Balance Transfer helps you reduce your EMIs by moving your outstanding loan from other financial institutes to the one which offers lower interest rate. Home Loan Balance Transfer or Refinancing or simply Balance Transfer is the process that allows

you to benefit from the lower interest rate offered by the other lender. If you have an existing outstanding home loan with one borrower, you can make a home loan transfer, that is, shift the remainder amount to a different borrower who charges a lower rate of interest, the process is termed as a home loan balance transfer or refinancing.

24 hour service

1000+ Consultants

5+ Years of Trust

10,000+ Happy Clients

This unique home loan transfer service helps a customer avoid high applicable interest rates as listed by one home loan lender and migrate to a lower interest rate structure with another lender. So why one would need a balance transfer? A home loan involves a significantly large amount of money and therefore, the interest rate on the loan is a matter of concern for everyone who decides to take a home loan. Home loan interest rates may range from 6.80 % to 12 % and one of the most common ways to reduce interest rates is to either talk to the bank that has provided you the loan to reduce it or go for a transfer of the balance on existing home loan or in layman terms, shift your home loan to a bank offering lesser rate.

Key Features

- Transfer the outstanding balance of you existing home loan to another bank or from one lender to another.

- There is a fee usually equal to 1% of the loan transferred that is payable to the new lender for home loan by the borrower.

- In most cases, the home loan balance transfer application is treated similar to a new home loan application.

- The balance transfer on an existing home loan can only be availed after a pre-determined time period as mentioned on the original loan agreement.

- When the transfer is completed, the borrower owes the transferred principal loan amount plus applicable charges to the new lender instead of the original one.

Loan Against Property

Loan against Property refers to the secured loan category like home loan where the borrower gives a guarantee by using his property as a security. The right of ownership of the property is still with the borrower, and if he/she is unable to repay the loan amount, he/she can sell the property to pay off the debts.

Typically these loans are used to start or expand business or to renovate your house. But it can also be used to repay existing high rate loans

- The maximum loan amount varies from bank to bank. It could range from Rs.10 lakhs up to Rs.1 crore. The exact amount depends on your property valuation, income and of course repayment capacity.

- The rate of interest is usually 6.5%+, but depending on one's profile and the Bank's criteria, it may vary.

- The maximum loan amount can come upto 50% of property value for commercial setups and up to 60% for residential properties.

- The maximum loan tenure is 15 years.

- You require security, collateral or guarantors for obtaining a Loan Against Property.

- Most banks do not accept properties that are on lease or that are based on power of attorney.

- You require security, collateral or guarantors for obtaining a Loan Against Property.

- You can choose either Fixed or Floating rate of interest. You also have an option of changing from Fixed to Floating interest rates and vice versa once every year.

- A processing fee is usually 0.05% to 3% of the loan amount and is payable upfront. This fee however will be deducted from the disbursal amount payable to you. You should always ask for the 0% processing fee or negotiate the processing fees.

- You can also prepay the entire loan outstanding anytime after 180 days of availing the loan. Prepayment charges will be levied accordingly. If you intend to do so, please ask for the pre-payment amount to be waived or a reduction in the penalty charges.

- You can also increase or enhance your loan loan against property eligibility. For that you need to show income of atleast three persons, most preferably a family member or a business partner

Know these pointers before availing a LAP:

- Decide on the basis of what you really need. Also see if the cost fits into your estimated budget.

- Compare the quotations given and interest rates from 3-4 banks, select the one which offers maximum benefit and serves your purpose.

- Also determine the tenure of the loan. The EMI may come less for longer tenure, but the total interest outgo will be higher

- Know all about processing fees and time. Some banks may waive the processing fee for processing loan but they build this cost on their interest rates.

- Consider pre-payment options. All banks charges 2% - 3% of the loan in case you decide to pre-pay the outstanding amount.

- Default in payments results in penalties. It can also adversely affect your credit history and profile. So make sure to make your payments on time.

- Make sure that all deals and offers agreed upon are supported by relevant papers. So make sure you always ask for a letter in a banks letter-head mentioning the likes of, exact rate of interests, processing fees, pre-payment charges along with interest-schedule.

- Also before signing the documents, make sure you recheck all terms and conditions.

- Do not at any circumstance give any false information. This may amount to fraud and could land you in trouble.

- Do not sign any blank documents. Even if it takes you a few hours to fill-up the form, please do so. Do not leave anything for the executive to fill-up.

- Finally, once you have received a loan do your best to pay it back as quickly as possible. Banks make their money off the interest they charge and the sooner you pay back a loan the less money you will have to pay in interest.

Business Loans

Business loan is the primary unsecured type of funding, designed to meet the day-to-day business requirements of individuals, entrepreneurs, micro small, medium and large enterprises. Borrowers are not pressurized to submit any collateral or security to avail unsecured business loan.

Business loans can be used for business expansion purposes, manage cash flow, buy equipment/machinery, hire/train staff, purchase raw materials, upgrade inventory and much more. Small business loans are also available for MSMEs and startups. There is no minimum loan limit criteria to borrow, whereas customers can avail collateral-free business loans up to Rs. 1 crore with flexible and customized repayment options.

Top Features

Interest Rate: 11.90% onwards

Nature of Loan: Short- and Long-term, Working Capital, Secured and Unsecured Loans

Minimum Loan Amount: No Limit to Borrow

Maximum Loan Amount: Up to Rs. 1 crore (collateral-free loans), can exceed as per business requirements

Repayment Period: From 12 months to 5 years

Check and Compare from available business loan options at competitive interest rates.

The fees and charges of business loan vary from lender to lender and case to case. The fees and charges depends on the loan amount, interest rate and repayment tenure.

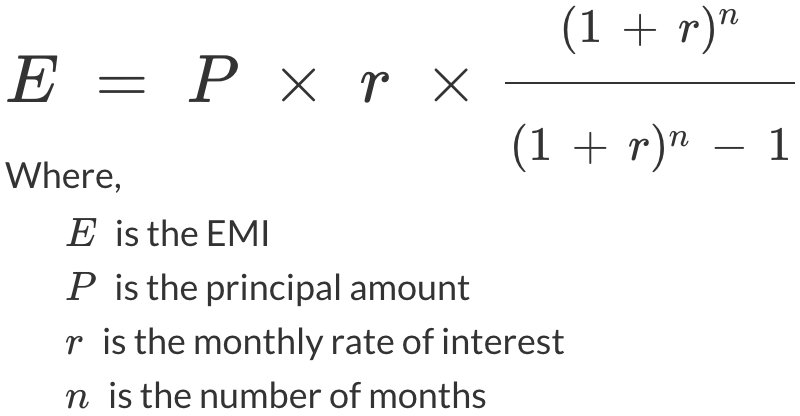

Business Loan EMI formula

After your loan application or loan is approved, bank will deposit the required loan amount in your

bank account. The time duration of loan processing and disbursal shall vary from lender to lender.

Personal Loans

Personal loan is the obvious choice if you need a finance for Personal finance, Medical emergency, Wedding purposes, Abroad travel, Holidays, Child education and for buying consumer durable things. Means if you have a requirement of money so personal loan is the best choice.

Personal loan Eligibility

Minimum per month Income of Rs.18500 in Metro cities required

Minimum per Month Income of 12500 required in other cities like Tier 1, 2 & 3

Age Must be above 21 Years

Regular Source of Income with Valid proof of income like – Pay Cheque, Account Transfer. Cash salary is not considered by any bank

Minimum 6 Month stability in current company for Salaried, 2 Years ITR for self-employed / Professionals

CIBIL SCORE must be above 750 points.

Latest Update as on 27 March 2020

The fees and charges of business loan vary from lender to lender and case to case. The fees and charges depends on the loan amount, interest rate and repayment tenure.

Wealth Advisory

Through proper asset allocation and risk analysis we help you to create ideal portfolio to grow your money at desired rate. Products are chosen from all asset classes - equity, debt, property, gold etc.

Project Finance

In Agastya, we arrange project finance mainly for Builders/Real estate Developers, Industrial projects (Green field/Brown field), Hospital projects, School projects etc.

The raising of funds to finance an economically separable capital investment project in which the providers of the funds look primarily to the cash flow from the project as the source of funds to service their loans and provide the return of and a return on their equity invested in the project.

The financing of long-term infrastructure, industrial projects and public services based upon a non-recourse or limited recourse financial structure where project debt and equity used to finance the project are paid back from the cash flow generated by the project.

Term Loan

In Agastya, we arrange term loan for Machineries, health care equipments, school building, hospital building etc.

Strong network of lending institutions helps us to arrange funds at very competitive rates.

Working Capital Finance

In Agastya, we arrange working capital finance for traders, wholesalers, distributors, and Industries.

We have strong network of lending institutions which helps us to arrange funds at very competitive rates.

Export-Import Finance

With our wide network of financial Institutions we provide assistance in arrangement of Pre shipment & Post shipment finance for import/export transactions at very competitive rate and in faster period of time.